-

Send Adrianne to her last Democratic Convention

Donate from this link.

https://www.gofundme.com/static/js/embed.js -

Relax! Taxes for Expats has you covered

And I’m giving you a $25 discount (well, they are)!

Use my referal link for the discount: https://www.taxesforexpats.com/ref/71

Not quite sure what you need? Check out all Taxes for Expats offers.

Use my referal link for the discount: https://www.taxesforexpats.com/ref/71

Why use Taxes for Expats?

- Woman owned company. Yes, that matters.

- Over 25 years experience preparing US tax returns for Americans living overseas.

- Clear and transparent working process and fees.

- Audit protection

- Rave reviews.

Use my referal link for the discount: https://www.taxesforexpats.com/ref/71

See you on the other side!

Home Insurance Arlington

-

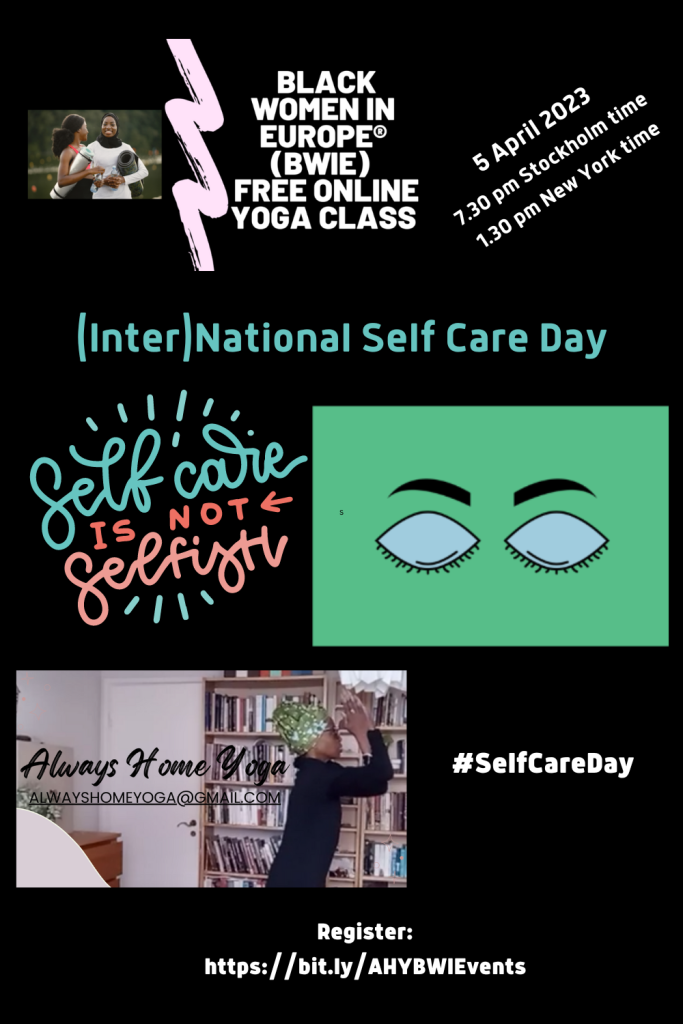

Self-care Yoga Class – grattis

Join Black Women in Europe™ and Always Home Yoga for our monthly karma class.

The month of April’s theme is self-care. Take one hour for yourself on 5 April @ 7.30 pm Sweden/1.30 pm New York time.

Register here: Register: https://bit.ly/AHYBWIEvents and share.

Home Insurance Arlington

-

Get your Yoga on at home

So many options to choose from.

Take the opportunity to deepen your knowledge.

Get started for free.

View all classes at YogaDownload.com

-

It was Indigenous Peoples Day on the 10th

The Government has adopted five action programmes against various forms of racism during 2022–2024. The action programmes outline concrete measures aimed at combating afrophobia, antisemitism, antigypsyism, islamophobia and racism against the Sami people. These action programmes will follow up on one of Sweden’s commitments from the Malmö International Forum on Holocaust Remembrance and Combating Antisemitism.

“We must never accept any form of racism. It’s a question of human dignity. Racism divides people and contributes to dangerous polarisation. That’s why we’re raising the level of ambition to emphasise everyone’s equal value,” says Minister for Culture Jeanette Gustafsdotter.

These action programmes will help draw attention to and counter various forms of racism. They supplement the national plan to combat racism, similar forms of hostility and hate crime. The action programmes were developed based on dialogues with representatives of civil society, reports on the occurrence of racism and hate crime in Sweden and recommendations from regional and international human rights bodies.

“Racism, discrimination and hate crime are harmful not only to the victims, but society as a whole. For this reason, efforts to combat racism and discrimination are also important for breaking segregation,” says Johan Danielsson, Minister for Housing and Deputy Minister for Employment with responsibility for efforts to combat discrimination.

Within the framework of the action programmes, the Government has tasked several Government Agencies to counter racism within health and medical care, to increase knowledge about the relationship between the vulnerability of certain groups and work-related stress, and to enhance knowledge about hate crime against the Sami people. Children and young people’s vulnerability to racism is given special attention through remits aimed at the schools.

Information box:

The action programmes draw on the national plan to combat racism, similar forms of hostility and hate crime. The national plan was adopted in 2016 and is a tool for preventing and combating racism and polarisation in society and paving the way for a cohesive Sweden characterised by solidarity. The actions programmes comprise measures in four of the five strategic areas identified in the national plan: more knowledge, education and research, strengthened preventive measures online, a more active legal system as well as Civil society: greater support and more in-depth dialogue.

Press contact

Victoria Frisk Garcia

Acting Press Secretary to the Minister for Housing and Deputy Minister for Employment Johan Danielsson

Phone (switchboard) +46 8 405 10 00

Mobile +46 73 047 23 12

email to Victoria Frisk GarciaAmelie Lind

Press Secretary to the Minister for Culture Jeanette Gustafsdotter

Phone (switchboard) +46 8 405 10 00

Mobile +46 73 087 87 43

email to Amelie Lind -

Swedish language and society course

If you have finished Sfi (or have equivalent knowledge of Swedish) there’s an online course starting November 1st that will focus on language as well as info about Swedish society. Classes are held on Zoom, two evenings/week at 18-20.15. The course is free of charge! Sign up on the website 😊 I did!

-

Flygbussarna to the rescue!

Tusen tack to the wonderful driver with Flygbussarna on 21 September from Göteborg Landvetter Airport to Gothenburg Central Station, Sweden, AND the customer service staff on site. After traveling through 3 airports I got off the bus in Gothenburg and left my two roller bags under the bus. UNDER THE BUS!! How could I do that? Once I realized it my bus had departed back to Landvetter. All I could do was make a report at the customer service office and wait and pray. And that I did this while customer service made contact with the driver and who finally returned on a scheduled run with my bags safely on the luggage rack behind him.

I gave him the BIGGEST hug after he gave me my bags. I couldn’t believe I was reunited with my bags. Tusen tack Vy flygbussarna for looking out for me, making me whole, and always being on time, lol.😀 Nice things happen to me in Sweden.

-

How the Sweden Democrats became the second biggest party

-

Visit family in the US. Vote in Sweden.

-

How to Vote in the Swedish Elections

In case you hadn’t picked up on it, there is a major election in Sweden next month. If you’re eligible to vote you don’t have to register. Your voting papers will come to you in the mail. Follow the instructions and join the 87% of voters in Sweden who actually vote. Impressive!

If you’re eligible to vote in Sweden but will be away (like me), here’s a link to how and where you can vote in the US,

along with a link to a resource to help you figure out who to vote for. Question: Are any Swedish politicians pictured in the screenshot, lol? I really have to do my research. #swedishelections2022

So I’ve taken the quiz and will study my results, check them twice and finish listening to the debate on expressen.se. Lyka till getting it done!

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.